Improvement in Leasing and Sublet Availability Trends Expected To Support Stronger Office Recovery in 2022

By Nancy Muscatello

CoStar Advisory Services

Leasing and sublet availability are heading in the right direction, and tenant search activity is on the upswing. Additionally, workers are returning to the office in higher numbers. According to key-card access data tracked by Kastle Systems, the share of workers returning to the office across 10 major cities reached 36.1% as of Oct. 6, still well below pre-pandemic rates, but the highest share since March 2020.

While uncertainty regarding future office space needs remains high, the recent improvement in leading indicators bodes well for an acceleration in the office market recovery in coming quarters.

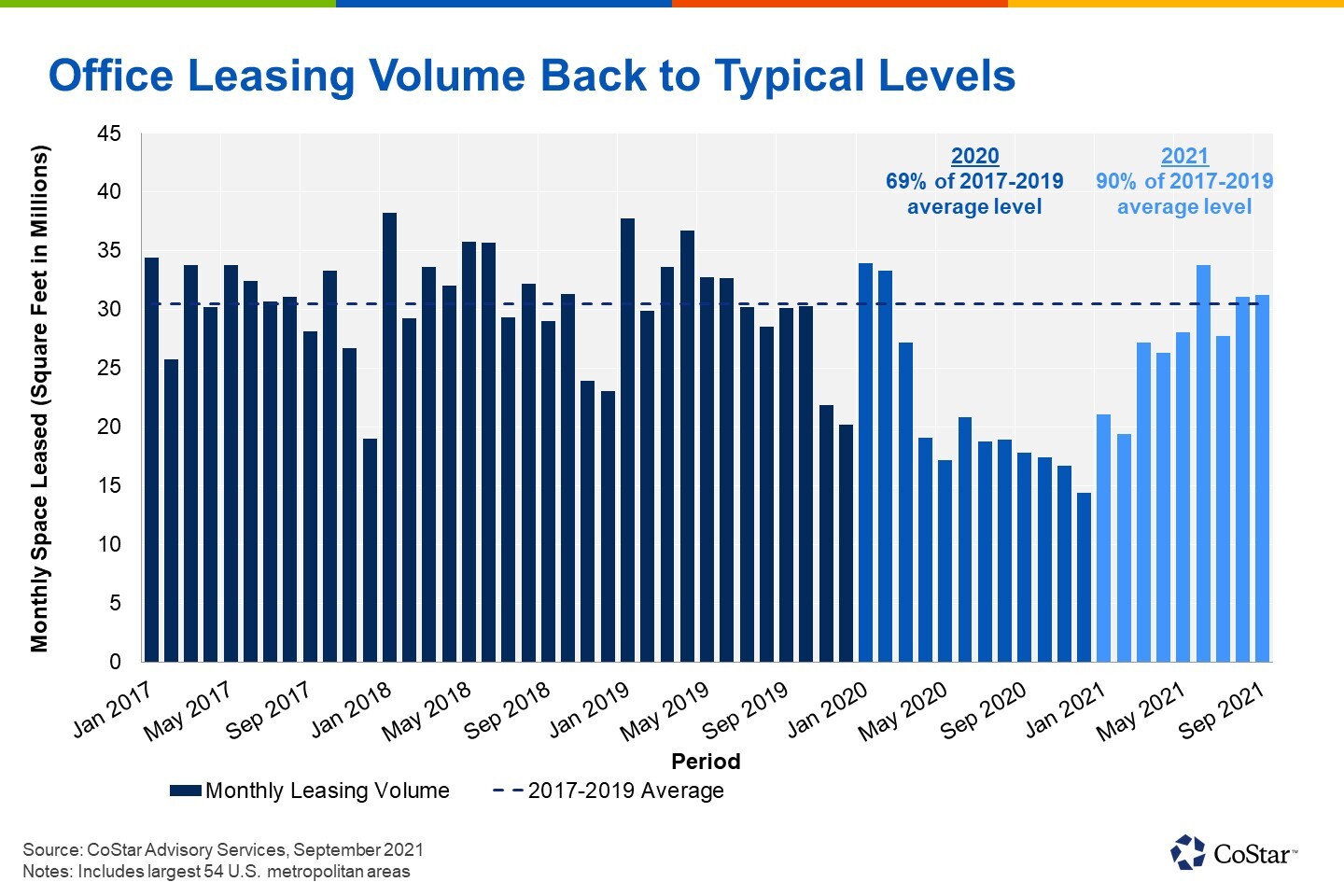

Office leasing volume has rebounded from the lows reached during the pandemic, when monthly signings fell to about 50% of typical activity. Over the course of 2021, leasing volume has accelerated, and from June to September, activity has returned to more normal historical levels, on par with or even exceeding typical monthly volume reached during the 2017-19 period.

Leasing activity as a harbinger of office demand has been accelerating across most markets in the country, suggesting a relatively broad-based rebound. The primary gateway markets experienced some of the largest decelerations in leasing volume during the depths of the pandemic, given added headwinds relating to more stringent lockdown measures, higher density and public transit dependence. However, the major gateway markets have experienced increased leasing in recent months.

Boston tops the gateway markets for achieving return-to-normal office leasing activity bolstered by life science tenant activity. San Francisco remains the laggard among the gateway markets, but leasing activity year to date through September improved to about 69% of typical levels. Recent leasing in San Francisco marks a significant improvement from mid-2020, when leasing volume fell to less than half of usual activity experienced in the few years preceding the pandemic.

Secondary markets, primarily those in the Sun Belt, have had a stronger rebound in office leasing activity overall, owing to generally lower density, less stringent lockdown measures and lower public transit dependence. Office leasing activity in the first nine months of 2021 has come back stronger than it was over the same period in the years prior to the pandemic in several markets including Miami, Florida; Nashville, Tennessee; and Tampa, Florida.

Certain tech-focused secondary markets, such as Austin, Texas, and Raleigh, North Carolina, have also been the benefactors of strong leasing activity on the part of major tech firms.

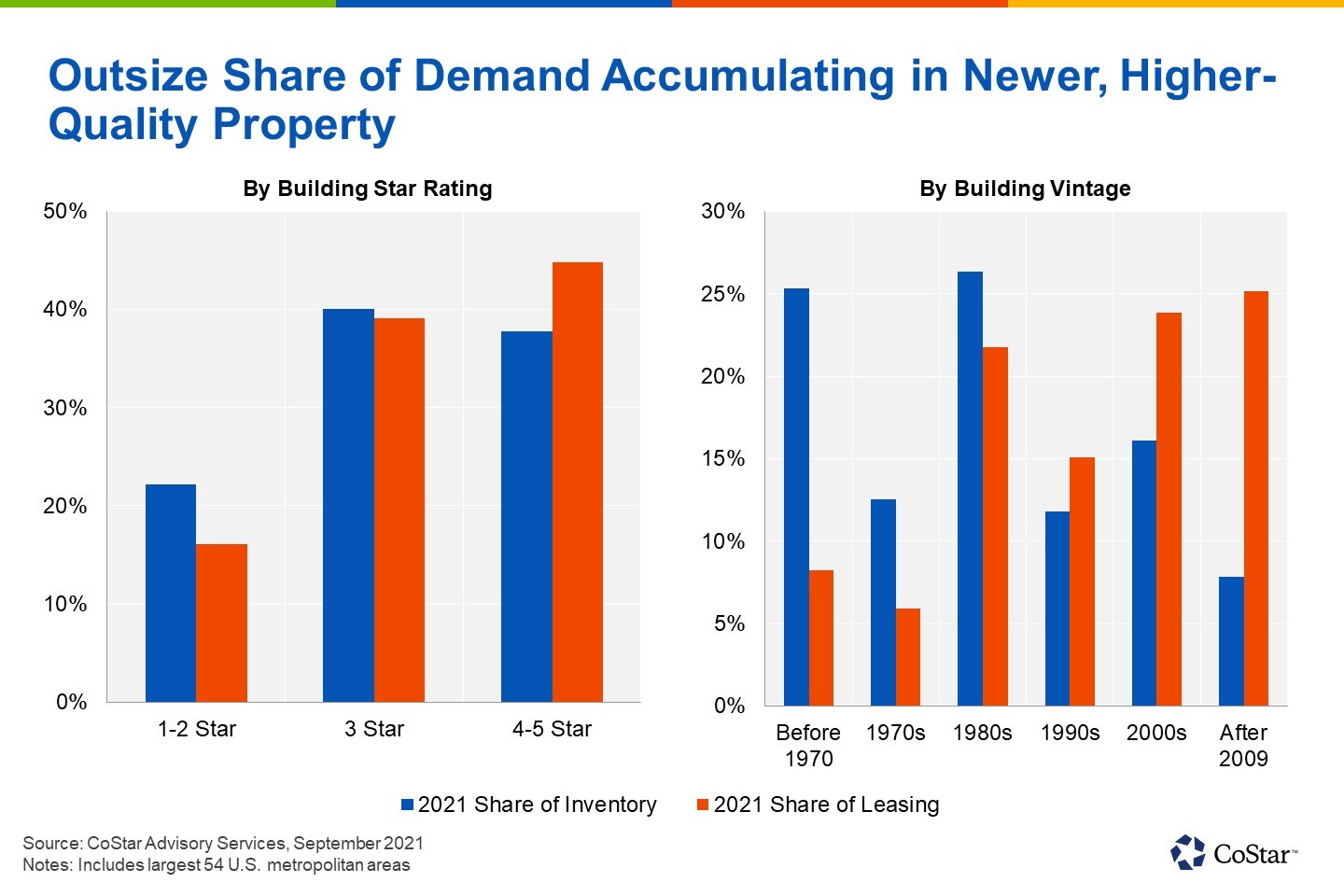

Leasing activity continues to skew toward newer, higher-quality office space as well. Roughly 45% of the office space leased in the first nine months of 2021 was in the highest-quality four- and five-star buildings, well above the 37% share of the national office inventory that these properties represent. At the other end of the quality spectrum, one- and two-star properties accounted for only 16% of leasing activity despite making up over 22% of the total office inventory.

Analyzing office leasing activity by building vintage, those built after 2000 continue to overwhelmingly garner an above-average share of leasing activity. Given that less new office space is being built today, and with demand accumulating in newer, higher-quality buildings, it is expected that this segment of the market will remain much healthier in terms of overall demand.

In addition to a rebound in leasing activity, the amount of available sublet space shrank in the third quarter of 2021 for the first time since 2019. While quarterly additions to the available sublet inventory had been moderating over the past year after peaking in the third quarter of 2020, they actually declined in the third quarter of 2021, falling by over 5 million square feet across the largest 54 U.S. office markets.

Some of the excess sublet space was leased. Sublet space is a desirable option for many tenants since rental rates are generally offered at a discount to asking rents on directly available space. In other cases, lease terms on sublet space expired, making those blocks directly available.

But perhaps most encouraging for the sector, some office tenants have changed their plans given the recently improving market conditions and pulled their available sublet space off the market to keep it for themselves. Sublet availability in the last quarter fell most dramatically in the tech-driven markets of Austin, San Francisco, Seattle, Boston and Denver.

While reductions in available sublet space are positive, total sublet availability still remains elevated relative to historical levels, representing 2% of total office inventory nationally, compared with an average of 1.2% over the last 15 years. The higher share of sublet availability will continue to compete with directly available space, putting downward pressure on rents.

The rebound in office demand metrics over the past several months is an encouraging sign. If return-to-office rates and leasing trends continue to improve as the surge in cases from the delta variant ebbs, increased office leasing and absorption is expected to follow.

While recent trends are positive, office headwinds remain. Over the near term, tenants continue to reassess their space needs while they settle on remote-working rates post-pandemic. In the meantime, downsizing by some tenants adopting hybrid work models is expected to continue.

On the supply side, new office deliveries are set to rise, with over 60 million square feet of office space coming online in the next two quarters across the largest 54 markets, representing the highest two-quarter delivery total since 2008. This increase in new supply is occurring at the same time that preleasing has fallen. Preleasing on in-process office construction has fallen to a cyclical low of about 62%, compared with an average rate of 77% over the past 15 years.

Another longer-term obstacle facing the office market is the slowing growth in the working-age population as the baby boomer generation retires and is replaced by the smaller Generation X cohort, a secular trend that has been affecting the market for years.

The growth rate of the population age 25 to 64 averaged 0.2% in 2019 and 2020, which was just one-third of the average growth in that cohort over the preceding 10 years. Continued weakness in working-age population growth may slow the recovery in office demand, but it is likely to have a stronger impact on the high-cost gateway markets more than the faster-growth, low-cost Sun Belt markets. Ultimately, office markets that can provide access to qualified labor will be in a better position to outperform.

While challenges remain, the office market is in the midst of a rebound. Tracking signs of recovery, while also remaining cognizant of existing and future obstacles, will help owners and investors navigate the evolving landscape.

Nancy Muscatello is a managing consultant with CoStar Advisory Services

Reviews